The Forex Margin Calculator can also be used to find the least "expensive" pairs to trade. For the same example above, and by using the same calculating parameters ( leverage and a lot trading position), if instead of selecting the EUR/USD we choose the AUD/USD, then we see that the margin required would be much less, only GBP 31/07/ · 日本語原稿はこちら. One of the most important elements of forex trading strategies is calculating leverage. At our Forex Coffee Break Education Course, we probably talk about the leverage formula a little too much, but certainly not enough. The reason is that the ability to trade on high leverage is one of the key differences between forex trading and other kinds of Leverage in forex is a way for traders to borrow capital to gain a larger exposure to the FX market. With a limited amount of capital, they can control a larger trade size. This could lead to bigger profits and losses as they are based on the full value of the position. Trading with leverage in forex, which is also referred to as forex margin

What Is Leverage In Forex Trading? With Margin Calculator

Leverage in forex is a technique that enables traders to 'borrow' capital in order to gain a larger exposure to the forex market, with a comparatively small deposit. It offers the potential for traders to magnify potential profits, as well as losses.

Forex is traded on margin, with margin rates as low as 3, forex leverage calculation. A margin rate of 3. This means you can open a position worth up to 30 times more than the deposit required to open the trade.

Leverage in forex is a way for traders to borrow capital to forex leverage calculation a larger exposure to the FX market. With a limited amount of capital, they can control a larger trade size, forex leverage calculation. This could lead to bigger profits and losses as they are based on the full value of the position.

This is because profits and losses are based on the full value of the trade, and not just the deposit amount. Forex trading comes with some of the lowest margin rates in the financial markets. Stock market leverage starts at aroundwhich makes trading within the share market slightly less prone to capital risk.

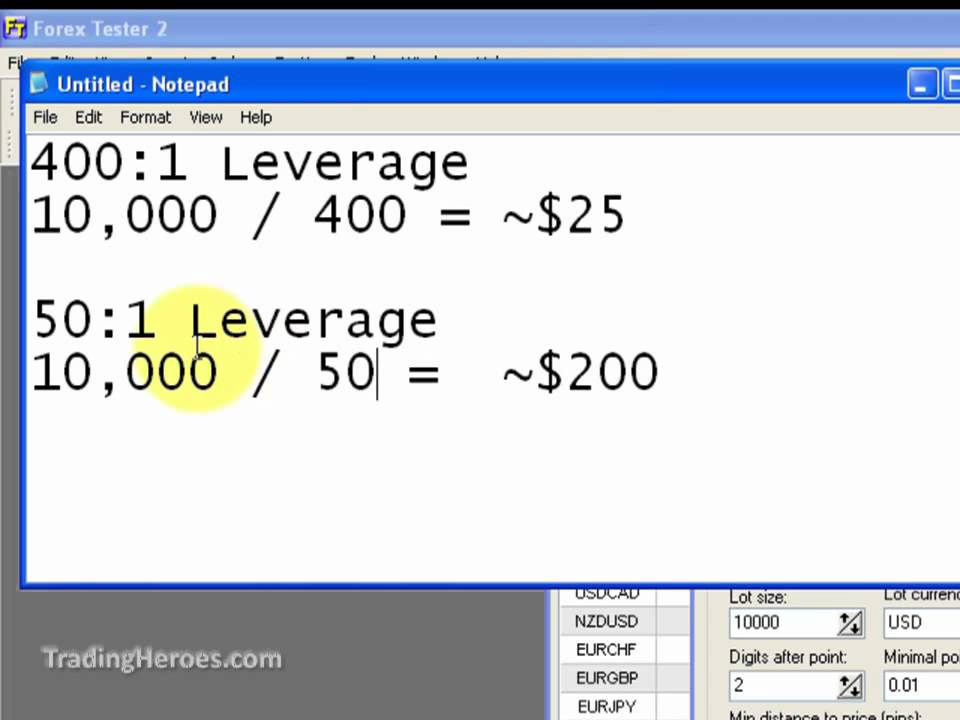

When trading forex on margin, you only need to pay a percentage of the full value of the position, which acts as a deposit. Margin requirements can differ between brokers, but start at around 3. A margin call occurs when your margin level has dropped below a pre-determined value, forex leverage calculation, where you are at risk of your positions being liquidated. A forex leverage calculator helps traders determine how much capital they need to open a new position, as well as manage their trades.

It also helps them to avoid margin calls by determining the optimal position size. You can also start with the margin amount and apply a leverage ratio to determine the position size.

As much as leverage trading can be seen as a way to increase your forex profits, it also magnifies your risks. For that reason, having forex leverage calculation effective risk-management strategy in place is essential for using leverage in forex. High leverage forex brokers usually provide key risk management forex leverage calculation, including the following list, which can help traders to manage their risk more effectively.

You are essentially specifying the amount you are willing to risk on the trade. However, even if a stop-loss is in place, the close out price cannot be guaranteed due to slippage. However, when the market moves in your favour, the trailing stop-loss moves with it, aiming to secure any favourable movement in price.

For this benefit, there is a premium payable on execution of your order, which is displayed on the order ticket. The premium is refunded if the GSLO is not triggered. A take-profit order works in the same way as a limit order as it is always executed at the target price you specify. Where the market for any product opens at a more favourable price than your target forex leverage calculation, your order will be executed at the better level, passing on any positive slippage.

Our award-winning platform comes with price projection tools, trading charts and graphs and drawing tools to ensure that you perfect using leverage in forex in whichever position you open.

While margin is the deposit amount required to open a trade, forex leverage calculation, leverage is capital borrowed from the broker in order to gain exposure to larger trading positions. Therefore, forex trading on margin enables traders to open larger positions with relatively small deposits. It is important to remember that trading on leverage can be risky as losses, as well as profits, are amplified.

Seamlessly open and close trades, track your progress and set up alerts. Join forex leverage calculationother committed traders. Complete our straightforward application form and verify your account. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Personal Institutional Group Pro. Australia English 简体中文. Canada English 简体中文. New Zealand English 简体中文. Singapore English 简体中文. United Kingdom, forex leverage calculation. International English 简体中文. Start trading. Products Ways you can trade CFDs Spread betting What you can trade Forex Indices Cryptocurrencies Commodities Shares Share baskets Treasuries ETF trading Product details CFD spreads CFD margins CFD costs CFD rebates.

Latest news Economic calendar Highlights Featured chart Our market analysts Michael Hewson Jochen Stanzl Forex leverage calculation Wong. Learn to trade CFDs What are CFDs? Advantages of trading CFDs Risks of CFD trading CFD trading examples CFD holding costs Learn cryptocurrencies What is bitcoin? What is ethereum? What are the risks? Cryptocurrency trading examples What are cryptocurrencies? The advance of cryptos. Help topics Getting started FAQs Account applications FAQs Funding and withdrawals FAQs Platform FAQs Product FAQs Charges FAQs Complaints FAQs Security FAQs Glossary Contact us FAQs How can I reset my password?

How do I fund my account? How do I place a trade? Do you offer a demo account? How can I switch accounts? CFD login. Australia English Australia 简体中文 Österreich Canada English Canada 简体中文 France Deutschland Ireland Italia New Zealand English New Zealand 简体中文 Norge Polska Singapore English Singapore 简体中文 España Sverige United Kingdom International English International 简体中文, forex leverage calculation.

Personal Institutional Group. Log in. Home Learn Learn forex trading Leverage in forex. Leverage in forex Leverage in forex is a technique that enables traders to 'borrow' capital in order to gain a larger exposure to the forex market, forex leverage calculation, with a comparatively small deposit.

See inside our platform. Get tight spreads, no hidden fees and access to 11, instruments. Start trading Includes free demo account. Quick link to content:. What is leverage in forex? What does a margin call mean in forex? Join a trading community committed to your success. Start with a live account Start with a demo. Forex leverage calculator A forex leverage calculator helps traders determine how much capital they need to open a new position, forex leverage calculation well as manage their trades.

Risks of leverage in FX trading As much as leverage trading can be seen as a way to increase your forex profits, forex leverage calculation, it also magnifies your risks. Take-profit order A take-profit order works in the same way as a limit order as it is always executed at the target price you specify.

Get started now by opening a live account Why not practise first with virtual funds on our demo account? Summary While margin is the deposit amount required to open a trade, leverage is capital borrowed from the broker in order to gain exposure to larger trading positions. Powerful trading on the go. Open a demo account Learn more. Apply for a live account Complete our straightforward application form and verify your account, forex leverage calculation. Fund your account Deposit easily via debit card, bank transfer or PayPal.

Find and trade One touch, instant trading available on 11, instruments.

What Leverage should I use when Forex Trading? Leverage EXPLAINED!

, time: 8:37Leverage Formula: How to Calculate Leverage in Forex - Invest Diva®

Leverage in forex is a way for traders to borrow capital to gain a larger exposure to the FX market. With a limited amount of capital, they can control a larger trade size. This could lead to bigger profits and losses as they are based on the full value of the position. Trading with leverage in forex, which is also referred to as forex margin 31/07/ · 日本語原稿はこちら. One of the most important elements of forex trading strategies is calculating leverage. At our Forex Coffee Break Education Course, we probably talk about the leverage formula a little too much, but certainly not enough. The reason is that the ability to trade on high leverage is one of the key differences between forex trading and other kinds of A leverage ratio calculation is complex however with our forex leverage calculator you just need to input a few values and calculate it easily: Currency pair - the currency you’re trading. Account currency - your account deposit currency. Margin - how much margin do you wish to use for the trade. Trade size - contract size or number of traded

No comments:

Post a Comment