04/12/ · FX Currency strength indicator is a visual guide that demonstrates which currencies are currently strong, and which ones are weak. FX Currency strength indicators include multiple calculation to choose from 1. Relative Strength Index (RSI) 2. True Strength Index (TSI) 3. Absolute Strength Index (ASI) 4. Linear Regression Slope (LRS) 5 18/01/ · How to use the Forex market Strength indicator. As an example, if GBP becomes strong we must Buy GBP. If we buy the GBP the results are as shown below. 1. GBP /AUD -BUY 2. GBP /NZD -BUY 3. GBP /USD -BUY 4. GBP /CAD -BUY 5. GBP /CHF -BUY 6. GBP /JPY -BUY blogger.com GBP -SELL blogger.com The beginning currency becomes to strong-Buy that forex The Forex currency strength meter takes takes readings of different currency pairs over a specified period of time, and applies calculations to each of them individually. Afterwards, it combines together each associated and determines the overall live strength of the individual currency pair (e.g. GBP/USD, EUR/USD, USD/JPY, AUD/USD, EUR/GBP etc.).Email: support@blogger.com

Forex market Strength indicator. - blogger.com

by TradingStrategyGuides Last updated Feb 17, Advanced TrainingAll StrategiesForex StrategiesIndicator StrategiesIndicators 12 comments. The currency strength indicator is the secret weapon of successful trading.

Through this trading forex currency strength indicator, our team of industry experts will reveal our proprietary currency strength indicators pack.

You will learn why our in-house indicator is superior along with an unorthodox currency strength trading strategy.

Learning to use a currency strength meter can help forex traders execute their positions with a greater sense of precision. The value of any given currency pair such as USD: GBP will constantly change over the course of any given trading period.

By combining the right forex trading tools forex currency strength indicator a robust currency strength trading strategy, you can immediately improve your daily trading outcomes. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Make sure you hit the subscribe button, forex currency strength indicator, so you get your Free Trading Strategy every week directly into your email box. Looking at a chart to determine which currency is strong and what currency is weak can be quite confusing, forex currency strength indicator.

When you factor in the intraday noise or the multi-timeframe analysis things can get even more complicated. Other variables, such as geopolitics, alternative markets, forex currency strength indicator, and economic reports can also cause the value of a given currency to change very quickly.

Looking at the minute chart, it appears the EUR is the strongest currency against the US dollar. However, when analyzing the same currency pair on the 1-hour and 4-hour charts, you have a new revelation. As we will explain throughout this currency strength trading guide, the time-specific time frames you are using as a trader can directly affect your trading outcomes.

When the forex charts do not clearly indicate the value of a currency, forex currency strength indicator, a currency strength indicator may be needed.

The entire goal of any forex trading strategy is to determine which currency pairs are about to change in value. If the dollar USD is about to increase in relative value while the Euro is about to decrease in relative value, forex traders will want to exchange their Euros in exchange for Dollars as soon as they possibly can.

Naturally, forex currency strength indicator, to develop a successful forex trading strategy, forex currency strength indicator, it becomes essential to know the strength of the underlying currencies at any point in time. Using currency strength meters, currency strength indicators, and other useful trading tools can help forex traders improve their strategies and remain ahead of the global market.

As the name suggests, the currency strength indicator is an MT4 custom-made indicator that is designed to reveal the strength of a particular currency pair against other peers. At the same time, the relationship between the currency pairs is organized according to their level of strength or weakness.

What this does is take the overall strength of the entire market so you can use it to your advantage. This will give you a trading opportunity that will combine the strongest and weakest forex pair. This combination is unique to the forex market and it allows you to get highly accurate trade entries. There are many currencies in the forex market and the currency strength meter is a tool to help you determine the best pair to trade on any given day. It is important that traders use tools to assist them to make trading decisions because we want to eliminate as many unsuccessful trades as we possibly can.

Some can be based on the rate of change ROC, or the RSI, or the CCI, or some type of Intermarket correlation. Our team of industry experts uses more than the change in price over a fixed period of time to calculate the currency strength.

We use a proprietary trading formula that aggregates prices from multiple time frames and apply our own weightings to produce the most effective currency strength indicator. Our proprietary formula to calculate the currency strength works better than all other free currency strength indicators combined, forex currency strength indicator. We offer a comprehensive approach to determining the value of the underlying currency, forex currency strength indicator, allowing traders to develop a dynamic strategy that delivers in various market conditions.

When using the currency strength meter, we analyze each currency individually rather than currency pairs. The whole idea is to identify the strongest currency and the weakest currency so you can choose the right currency pair to trade. Obviously, the basic idea behind the currency strength strategy is to buy strength and sell weakness. Once we determine which currency is independently about to increase in value, we can easily determine which currency pairs are about to experience a value change.

Understanding the connection between individual currencies and currency pairs will be crucial for anyone using the currency strength meter, forex currency strength indicator, or who is forex trading in general. This is nothing more but a form of trading in the direction of the trend. Or, trading with the prevailing momentum. Additionally, forex traders can wait until one currency shows forex currency strength indicator extreme strength reading and another currency shows extreme weakness reading and try to trade a reversal, forex currency strength indicator.

Currencies are different than, say, gold, because gold is physically finite. Supply is necessarily limited. Currency supplies, on the other hand, can be changed by central actors such as the central bank. Our currency heat map part of the 3 in 1currency indicator can help you gauge when a currency is losing its strength and a reversal is coming. Understanding how currency strength changes and how these changes affect the value of currency pairs can help improve your forex trading outcomes.

You can either use it as a standalone trading strategy or simply use the currency strength meter as a confirmation tool. We like to rely on our complex mathematical formula behind the Currency Strength Indicators Pack to measure the strength and weakness of a currency. We use the currency strength indicator to pair the strongest currency against the weakest currency, so you can take advantage of the momentum from both sides.

For example, according to our Currency Heat Map indicator right now, GBP is the strongest currency and CAD is the weakest. If you want to learn more about our proprietary currency strength indicator, here is a quick overview of its 3 main features:. As a general rule, we want the currency strength to forex currency strength indicator a new histogram bar with a different color above and below the zero line and at the same time or within a maximum of histogram bars.

According to our proprietary currency strength current measurements, we can distinguish the following:. The NZD strength only appears after the EUR already printed 6 histogram bars of weakness. The heat map can be used as a good barometer to gauge the short-term strength and weakness of currencies.

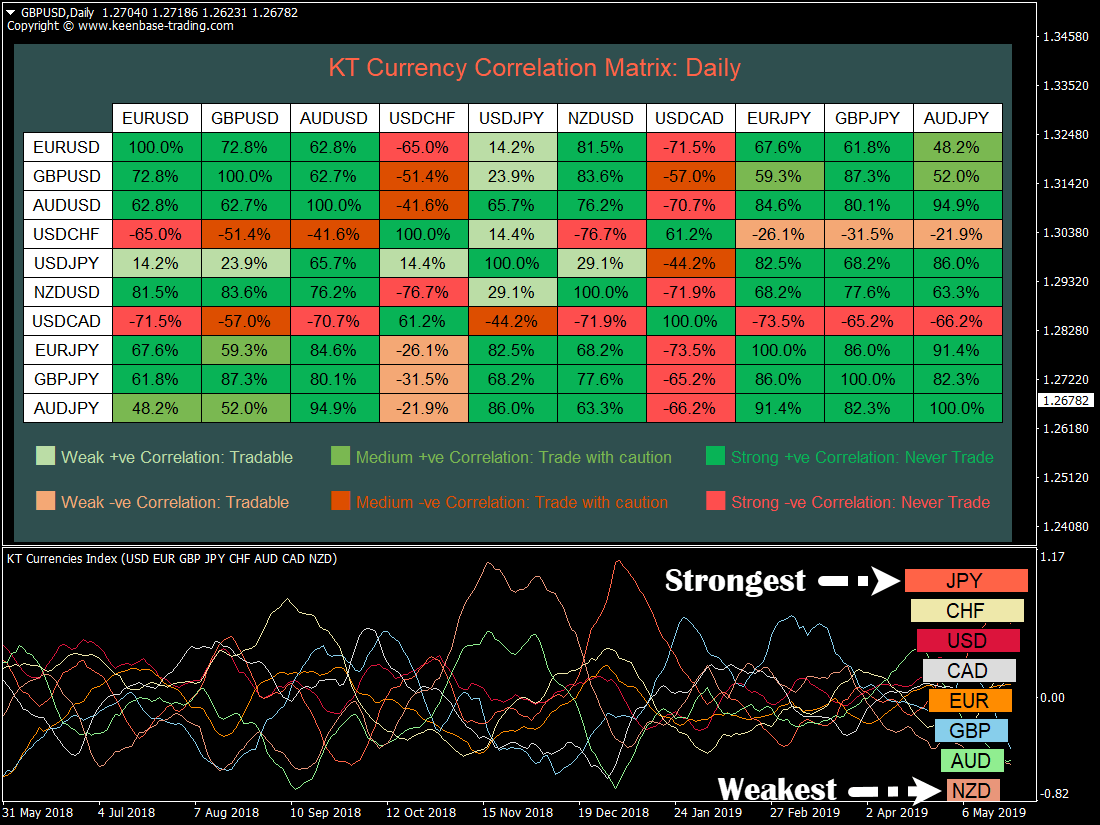

According to the current heat map readings, NZD is the strongest currency against all other major currencies and CHF is the weakest currency. In comparison with the other two strategies, the currency matrix will give us a more detailed view of the strength of the currency on multiple time frames.

On a closer look, we can see that despite the fact that the CHF is the strongest currency, in the intraday time frames we can see a different story. When all the time frames forex currency strength indicator and point in the same direction you know we have a strong reading of the currency strength and weakness.

If we study the currency matrix again, forex currency strength indicator, we can note that the USD is showing a constant reading across forex currency strength indicator of its time frames. The different shades of green on all USD time frames show real strength. The best way to measure the strength of a currency is by using a currency strength meter. This currency strength indicator will automatically determine if one currency is stronger or weaker relative to another currency.

As of 31 Marchthe strongest currency in the world is estimated at USD 3. The second strongest currency in the world is Bahrain Dinar, the official currency of Bahrain, estimated at USD 2. The cheapest currency in the world suffered significantly due to hyperinflation. First, download the Currency Strength Meter on your local PC. Next, you can run the Currency Strength indicator on any chart and currency pair you prefer with a simple drag and drop click.

If you want to receive alerts when there are changes in the strength of a currency you can get daily currency power alerts via Telegram. The alerts are delivered at the start of every trading session; when there are strong changes in the strength of a particular currency pair and alerts with high probability buy and sell signals based on the currency strength meter. Understanding currency strength will be key for developing a long-term forex trading strategy. The strength of a currency is a clear indicator of whether corresponding currency pairs are about to experience a change in value, forex currency strength indicator.

The currency strength index, the currency strength meter, and other currency strength indicators will directly affect your ability to determine whether a relative value change is likely to occur.

The currency strength indicator can be very appealing especially for beginner traders who are still in the process of learning how to trade. Here is a secret all forex traders need to know. Instead of trading currency pairs, try trading individual currencies as a whole. To accomplish this you will need to determine the strongest and weakest currencies to trade. And here is where our proprietary Currency Strength Indicators Pack comes into play.

If you want to learn how to find the strongest and weakest currency to trade, lay your hands on the Currency Strength Indicator, forex currency strength indicator. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan forex currency strength indicator step-by-step rules to follow.

How do you treat is that? Powerful information indeed. Just want to check how can I get hold of your currency strength indicator.

It's the best strategy forex currency strength indicator. I have been loosing trades forex currency strength indicator I know with the new trading strategyI will be a millionaire soon. This step-by-step guide will show you an easy way to trade with the MACD indicator. Get the free guide by entering your email now! Please log in again. The login page will open in a new tab.

After logging in you can close it and return to this page. Currency Strength Indicator — Currency Strength Meter Strategy by TradingStrategyGuides Last updated Feb 17, forex currency strength indicator, Advanced TrainingAll StrategiesForex StrategiesIndicator StrategiesIndicators 12 comments.

In the forex market, these types of conflict analysis happen all the time. Conflicting signals on different time frames, and across different currencies is the norm. Table of Contents hide. Author at Trading Strategy Guides Website. Solomon Adedokun says:. May 26, at pm. SAEED says:. February 9, at am.

DeepspaceForex - Currency Strength Meter - THE BEST ONE OUT THERE! 2020

, time: 20:46Currency strength indicator | Myforex™

The Forex currency strength meter takes takes readings of different currency pairs over a specified period of time, and applies calculations to each of them individually. Afterwards, it combines together each associated and determines the overall live strength of the individual currency pair (e.g. GBP/USD, EUR/USD, USD/JPY, AUD/USD, EUR/GBP etc.).Email: support@blogger.com 18/01/ · How to use the Forex market Strength indicator. As an example, if GBP becomes strong we must Buy GBP. If we buy the GBP the results are as shown below. 1. GBP /AUD -BUY 2. GBP /NZD -BUY 3. GBP /USD -BUY 4. GBP /CAD -BUY 5. GBP /CHF -BUY 6. GBP /JPY -BUY blogger.com GBP -SELL blogger.com The beginning currency becomes to strong-Buy that forex 29/06/ · Currency strength indicator. Select ON if you wish to only display the line graph of a specific currency pair. Specify the currency pair to display the line graph when "Show specified currency pair" is ON. Specify the period by the hour to calculate the currency strength. Use values 1~24 for best results

No comments:

Post a Comment