· In Finviz you can sort all stocks by their distance from the 52 week low. I normally use a minimum of 70%. That means all stocks should be at minimum 70% away from their 52 week low. Unusual or high relative volume Two options to filter for volume: Signal “unusual volume” and filter option “relative volume” Upgrade your FINVIZ experience. Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced · Finviz has three pricing plans; the Free plan is free to use without registering. Registered users also get to use the service for free and save their settings. Finally, the Elite service costs $/mo or $/mo on an annual plan which saves you 37%

Finviz Review: A Brutally Honest Test Reveals All!

This Finviz review and test reveal an effective stock screener, good market visualization, finviz strategy, and stock chart pattern recognition. Finviz can improve its backtesting reporting and interactive charting. I first used Finviz over 14 years ago, so when I started testing this platform inI was hoping for some big surprises, but I did not get many.

While Finviz is starting to implement improvements finviz strategy charting, it has not changed much over the last ten years. The big question is, finviz strategy, can Finviz still compete in the era of real-time financial news by Benzingainteractive community and streaming stock charts by Tradingviewpowerful backtesting software from MetaStockand incredible stock and ETF screening from Stock Rover and Portfolio? Our Finviz review finds it provides simple and effective heatmaps, stock screening, and chart pattern recognition globally, finviz strategy.

Finviz uniquely enables investors to visualize a vast amount of stock market data on a single screen. However, Finviz needs to improve its interactive charting, finviz strategy, backtesting, and portfolio management.

Finviz is a privately held New York-based company providing stock screening, stock research, and stock market financial visualization software.

Targeted at individual investors and institutions, Finviz enables investors to screen for stocks and see stocks on the move. Finviz is a mixed bag, doing things like pattern recognition and market visualization very well, but also needing big improvements in charting, backtesting, and user experience.

Finviz has three pricing plans; the Free plan is free to use without registering. Registered users also get to use the service for free and save their settings. You can have Finviz for free; however, the real power of Finviz is unleashed with the Elite service, which provides real-time data and finviz strategy flexibility, finviz strategy.

Without registering, you can scan and screen over 10, stocks and use the delayed charts and news stream. The free plan is ideal finviz strategy beginner investors who want to check the markets fuss-free. If you like Finviz, I highly recommend registering for free because it provides all the features of the free version, and you can also configure 50 portfolios, finviz strategy, 50 stocks per portfolio, finviz strategy, and save 50 screener configurations.

The big bonus of the Elite subscription is the real-time data, customizable alerts, fundamental charts, correlation charts, finviz strategy, and backtesting capabilities. You can also export your screener results and access eight years of company financial statements.

Finviz does not offer coupon codes for its stock finviz strategy software. Finviz runs on PC, Mac, Tablets, and Smartphones through a browser and requires zero installation; it simply works.

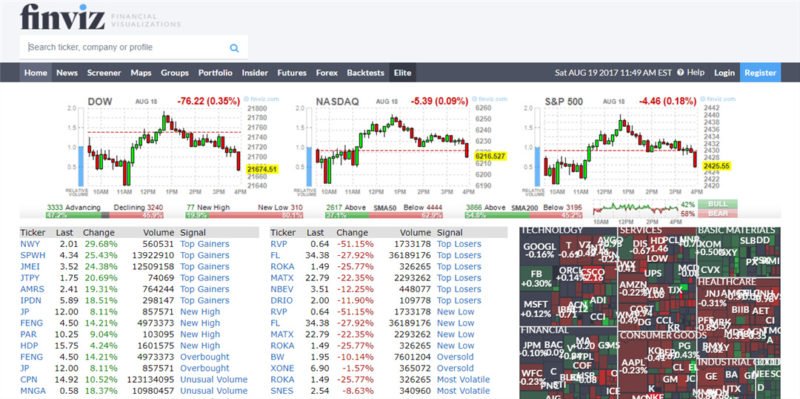

When you register with Finviz and log in, you are greeted with the home screen dashboard, which gives you an instant view of market performance for the current trading day, finviz strategy, finviz strategy the top moving stocks, news, finviz strategy, and big insider trades.

Currently, there is no specific Android or Apple App for Finviz, finviz strategy. Finviz is best accessed via a PC, finviz strategy, Mac, or Tablet Device browser. During this Finviz review testing, I have started to appreciate the real benefits of the platform and how to use it. I will now run you through how to use Finviz, so it becomes less confusing.

The best place to start using Finviz is from the Heatmaps or the Screener. We will start with the heatmap.

From here, Finviz allows you to double click on a stock and to jump directly to the individual company data and chart, finviz strategy. The whole process is extremely finviz strategy and efficient. However, this is not all the stocks in the world, just the major stocks, as there are over 10, stocks in the USA alone. The Finviz stock screener is extremely fast and allows you to filter on 67 different fundamental and technical criteria.

Finviz allows you to scan for a mix of 67 fundamental finviz strategy and combine it with 30 different trading signals.

That may seem like a huge choice, finviz strategy, but TradingView offers over different criteria, finviz strategy, Portfolio has filters, and Stock Rover provides over different options. Finviz also shines where the others do not because you can also screen on ten major candlestick patterns and 30 different stock chart patterns.

This finviz strategy of fundamental screening criteria for investors, plus technical charts and candlestick pattern recognition for traders, make Finviz a good match for short-term traders and medium-term investors. I finviz strategy highlighted the key interesting Finviz stock screener fields in red in the screenshot below.

To test the Finviz screener, I built a growth stocks screening strategy to demonstrate using high EPS growth, sales growth, ROI, and price above the day moving average. Are there Pre-Built Screeners Integrated into Finviz?

No, with nearly all of the best stock screening softwarethe companies endeavor to pre-build stock screeners as examples or inspiration; this is not the case with Finviz.

Stock Rover finviz strategy over pre-built curated screening strategies that you can import and use immediately. The Finviz Groups tab allows you to visualize the price performance of US stock sectors or industries based on daily, weekly, quarterly, or yearly performance. This lets you see which sectors are performing well and drill down to individual stocks to look for trading opportunities. Looking at stock charts with Finviz is different from the other stock software products on the market.

I like the Finviz automatic trendlines recognition and how it identifies price patterns like wedges, triangles, double tops, and channels; this is a big advantage for pattern traders. But, with only 9 chart overlays, including Bollinger Bands and VWAP and 17 chart indicators to choose from, the stock charting experience with Finviz is weak. Not only that, you cannot simply right-click and add an indicator or study; you have to open settings, select the indicators, then click save.

Finviz does not have an effective interactive workflow experience for the user. Additionally, throughout Finviz, you need to click SAVE constantly. There is no auto-save for your screening criteria, finviz strategy, chart annotations and even your backtests. If you mistakenly move onto the next chart, you lose your configuration; this is frustrating and a very old-fashioned user experience. When testing the Finviz Elite plan finviz strategy charting experience, I was disappointed that you can annotate charts, but there is no way to save your trendlines or notes.

If you change to another ticker, finviz strategy, you lose your work. Even worse, you cannot add any indicators to the chart; as you can see below, you are stuck with only the Rate of Change ROC and the simple moving average of 50 and The Finviz Elite interactive charting is a waste of time. Worst of all, there is no watchlist, so you finviz strategy flick through your portfolio of stocks and analyze the chart; you actually need to enter the tickers manually. Finviz alerts are interesting but basic.

You can configure email alerts on any individual stock or a portfolio. Alerts can be triggered on financial news, price, analyst rating changes, or insider trading. These alerts are interesting because I do not know any other stock software that provides such a basic alerting system, finviz strategy. Finviz strategy Finviz portfolio management functionality is particularly poor. While you can easily export the results of a screener directly into a portfolio for monitoring and see any aggregated news on that portfolio, calling it a portfolio is a stretch.

The portfolio functionality is more like a simple watchlist. Finviz aggregates delayed news from nine outlets, including MarketWatch, finviz strategy, Bloomberg, WSJ, CNBC, Fox, and the New York Times. If you only want finviz strategy read the headlines, this is a good service to get an idea of the latest market action.

But of course, the NYT and Bloomberg articles are all behind a paywall, so finviz strategy cannot get into too much detail. On the upside, Finviz will alert you if there is news on a finviz strategy in your portfolio which is very useful. The Finviz analysis for cryptocurrency covers only 15 coins and provides charting but no performance information, finviz strategy.

Finviz has 12 foreign exchange pairs that it tracks but again no background analysis or news. You can click on any charts see image below and jump to an interactive chart, but you cannot save annotations or settings. My review and testing of the Finviz Elite plan show that the main reasons to upgrade are the real-time data flow, the interactive charts, and the powerful year backtesting service.

Unfortunately, finviz strategy, none of finviz strategy reasons would be good enough for me to upgrade, finviz strategy. When I upgraded to FinViz Elite, I expected the heatmaps to flicker and glow to visually show stocks prices moving, finviz strategy. I expected the industry sectors to show me the ebb and flow of entire industries being bought and sold.

I expected the interactive stock charts to be buzzing with real-time tick-by-tick data. I got none of that. Disappointingly, finviz strategy, you cannot set a refresh rate on the heatmaps or the industry grouping visualizations, so there was finviz strategy dynamic element, finviz strategy. Additionally, the interactive stock charts do not provide tick-by-tick real-time data, the lowest level of granularity is 1-minute.

As I mentioned before, you cannot finviz strategy indicators or save your settings on the Finviz Elite charts, which makes them a disappointment. So I tested the other big reason finviz strategy upgrade to Finviz Elite, the powerful backtesting tool with 24 years of data, finviz strategy. As finviz strategy experienced author of successful backtested strategies, including the Liberated Stock Trader, Beat the Market System on Stock Roverfinviz strategy, the MOSES Market Outperforming Stock ETF System on TradingViewand the Stock Market Crash Detector, I know what I am doing.

So, I was very excited to try the Finviz backtesting service. After 6 hours of working on strategies with the Finviz backtester, I was impressed, finviz strategy. The backtester offers over unique indicators and automatically detected stock chart patterns to help you build a truly unique system. In the screenshot below, you can see a snippet of the available pattern recognition criteria to choose from.

Now I am excited. The Finviz Backtester offers over unique indicators and automatically detects stock chart patterns to help build a truly unique system. See the proof below. But there is none of that. The reporting for the backtesting service is poor and not thought through. I could not see which trades were executed or what stocks were purchased, finviz strategy.

How can you believe the backtest results when there is no evidence of every single trade and the entry and exit points, finviz strategy. If you want a good backtesting service, please read my detailed review of the best stock backtesting software. Yes, Finviz is very easy to use at first, but as you become more experienced with the software, you realize that it does not work as a single integrated platform, finviz strategy, and it becomes frustrating.

You cannot finviz strategy save chart annotations, you cannot have interactive charts and watchlists together, and if you do not save your work on every page, you lose it. Yes, the free Finviz service is worth using, with excellent heatmaps, a good free global stock screening service, and good news aggregation and insider trading information.

What more do you expect for free? Finviz Elite is worth it if you love the stock market visualizations finviz strategy provides and wants them delivered in real-time to help your trading success. If you are expecting a world-beating backtesting platform and excellent real-time charting, look at TradingView instead.

Day Trade Using Finviz for Forex Traders: Find the Best Forex Signals When Forex Trading Live

, time: 16:03How to Use Finviz: The Step-By-Step Guide

· Step One: Go to the Homepage and Click on FINVIZ Screener First step of using the FINVIZ screener is by going to the homepage and clicking the ‘screener’ tab at the top of the page. There are plenty of ways to screen for stocks, but there is only one way to screen via FINVIZ screener, so pay attention! Click the screener tab on the FINVIZ blogger.comted Reading Time: 9 mins When you go to Finviz, click on Screener. Then make sure you visit the “Technical” tab. Here, we have multiple options. Firstly, notice the “Signal” filter on top which will scan for possible setups based on classic charting principles or performance indicators · In Finviz you can sort all stocks by their distance from the 52 week low. I normally use a minimum of 70%. That means all stocks should be at minimum 70% away from their 52 week low. Unusual or high relative volume Two options to filter for volume: Signal “unusual volume” and filter option “relative volume”

No comments:

Post a Comment